Reconciliation, settlement, and billing

View transaction status and reporting

The Peach Payments Dashboard provides a transaction listing for monitoring and reporting.

To understand why payments are sometimes unsuccessful, see the Dashboard response codes section.

When signing up with Peach Payments, you confirmed two email addresses that Peach Payments sends the below emails to. Contact support to add or change any of these.

- Technical assistance

- Technical notifications for system status - sign up for notifications on status.peachpayments.com

- Reconciliation emails

- Invoice emails

For any finance-related queries, such as settlement, invoices, billing, and so on, contact [email protected].

Reconciliation

To learn more about reconciliation reports and the Reconciliation API, see the Reconciliation section.

Settlement

Settlement is the payment of funds into your business bank account for the money collected from customers when they buy from your online business. You should receive net settlement (the balance of the total incoming amounts (for example, debits) less outgoing amounts (for example, refunds)) from your bank or Peach Payments regularly, with the cadence varying per bank.

If you signed a merchant account agreement directly with a bank, for example, Absa, Nedbank, or FNB, you are using an ISO merchant account with that bank. If you didn't sign an agreement directly with a bank, you are probably using a Peach Payments merchant account.

Peach Payments might withhold settlement for various reasons, including outstanding FICA documents, suspected fraud, chargeback disputes, sudden spikes in transaction volumes, incomplete verifications, outstanding fees, and so on. These measures are in place to ensure a secure, trustworthy environment for all parties involved in the payment process.

Independent Sales Organisation (ISO) merchant account

Nedbank

You should receive net settlement from Nedbank every day. What you make online today should reflect in your bank account in the usual bank clearing periods (typically one business day).

For example, Peach Payments settles all sales from today less any refunds or reversals paid today, tomorrow. Settlement for 31 January happens on 1 February.

Your bank statement should include a Nedlink DP <merchant number> line item, for example, Nedlink DP 2552555.

Absa

You should receive net settlement from Absa every day (except Monday). What you make online today should reflect in your bank account in the usual bank clearing periods (typically two business days).

For example, Peach Payments settles all sales from Monday less any refunds or reversals paid on Monday, on Wednesday. Settlement for 31 January happens on 2 February.

FNB

You should receive net settlement from FNB every day. What you make online today should reflect in your bank account in the usual bank clearing periods (typically two business days).

For example, Peach Payments settles all sales from Monday less any refunds or reversals paid on Monday, on Wednesday. Settlement for 31 January happens on 2 February.

Peach Payments aggregation merchant account

For Peach Payments aggregation merchant accounts, you receive free net settlement for every payment method every day, excluding weekends and public holidays:

| Customer makes payment | Peach Payments settles |

|---|---|

| Monday, Tuesday, Wednesday, Thursday | Next business day |

| Friday, Saturday, Sunday | Monday |

| Public holiday | Next business day |

Peach Payments makes a single deposit for all your payment methods less any refunds or reversals into your bank account on one day, and you should see it reflect in your bank account the next day, depending on bank clearing periods.

Peach Payments sends an email with each settlement processed which includes a link to the settlement reconciliation report to your reconciliation contact on the Dashboard. The email contains the total amount Peach Payments is settling, and a settlement summary that includes the transaction period, the deposit reference, and a payment method breakdown.

To change the reconciliation contact, create a support ticket.

You can also download settlement reconciliation from the Dashboard.

Billing

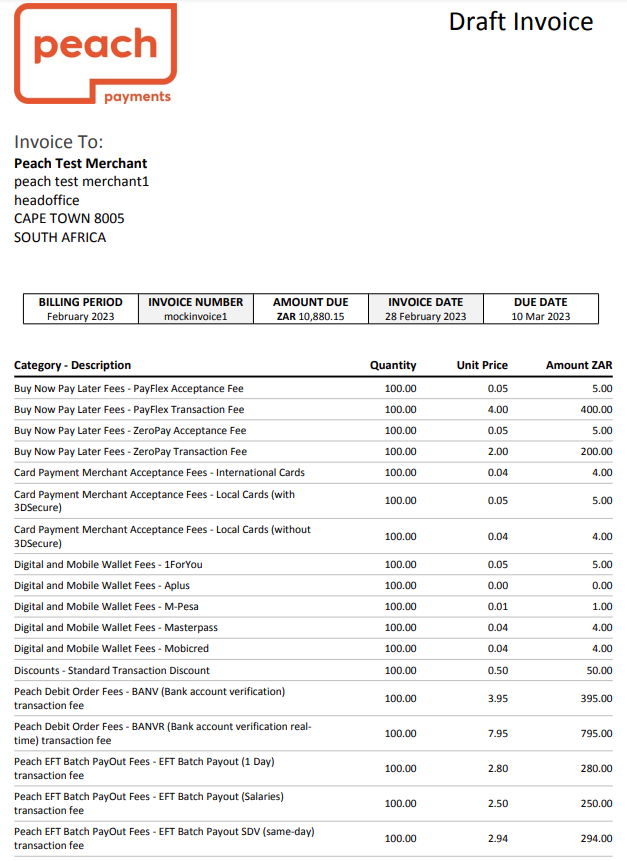

Peach Payments sends you an invoice for the previous month in the first four business days of each month. The invoice contains a list of transaction types and corresponding fees.

Payment is due by the 10th of each month.

In addition to the transaction types, the invoice uses the following terminology:

| Term | Description |

|---|---|

ACK | Transaction acknowledged as complete by the payment method. |

NOK | Transaction not acknowledged as complete by the payment method. |

SDV | Same Day Value EFTs reflect in the recipients bank account on the same day. |

When reading your invoice, keep the following in mind:

- The invoice includes fees in the following categories:

- Monthly fees, such as the payment method provisioning and tokenisation fees, don't generally change from month to month.

- Acceptance fees are a percentage of the value of the transactions.

- Transaction fees depend on the number of transactions. Certain payment providers charge transaction fees over and above the Peach Payments transaction fee. For example, for Payflex transactions, there are two transaction fee line items, one for the Payflex transaction fee (R4.00 in this example) and one for the Peach Payments transaction fee (R1.50 in this example).

- For card payments and PayPal, Peach Payments charges transaction fees for both

ACKandNOKtransactions, while for other payment methods, Peach Payments only charges forACKtransactions. - For Payouts, Peach Payments bills for successful payouts and payouts that result in

2000to2899response codes. These response codes are typically returned due to incorrect customer bank details or issues with the customer's bank account and occur because of merchant- or customer-provided information. - Your invoice only includes line items for payment methods and services that you use. For example, your invoice includes SMS line items if you send SMS notifications for payment links.

- If you do not pay your Peach Payments invoice by debit order, your invoice email and the invoice itself include links that you can use to pay the invoice.

- Quantity is either volume or value based. If the unit price on your invoice is a percentage, for example, 0.0295, the corresponding quantity is a monetory value. Otherwise, the quantity is volume based. The amount always equals the quantity multiplied by the unit price.

- Apple Pay transactions are always processed without 3-D Secure.

- Your invoice might call certain payment methods a different name, for example, on your invoice:

- Masterpass is Scan to Pay.

- 1ForYou is 1Voucher.

The following sample invoice, with fake transactions and fees, shows what line items you can expect on your invoice:

Page 1 of a sample invoice with fake transactions and fees.

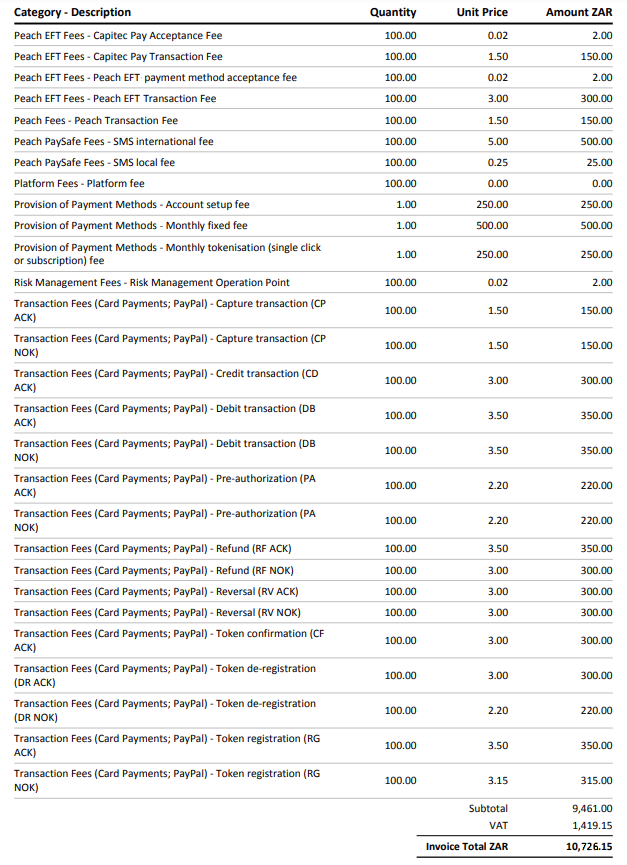

Page 2 of a sample invoice with fake transactions and fees.

From June 2025, you can use the itemised billing report to verify your invoice:

- Log in to the Peach Payments Dashboard.

- In the left navigation menu, click Billing.

- Download the report for the billing period that you're interested in.

The billing report downloads and you can use it to verify your invoice.

To verify the line item quantities listed on your invoice for periods before June 2025, use the Peach Payments Dashboard as follows:

- Log in to the Peach Payments Dashboard.

- Use the date fields to filter the transactions for the month in question.

- Export the resulting transactions to CSV and then download it.

- Open the export and compare the line items in your invoice to the exported transactions to verify that your bill is correct. For example, to find your Capitec Pay payments, filter on

brand, then count and sum the resulting rows to verify your Capitec Pay transaction and acceptance fees.

FAQ

When I log into the Peach Payments Dashboard, why can't I see any transactions? After you've logged in, the Dashboard displays the current day's transactions. To view more transactions, ensure that you filter for the date range that you want to view.

Updated 28 days ago